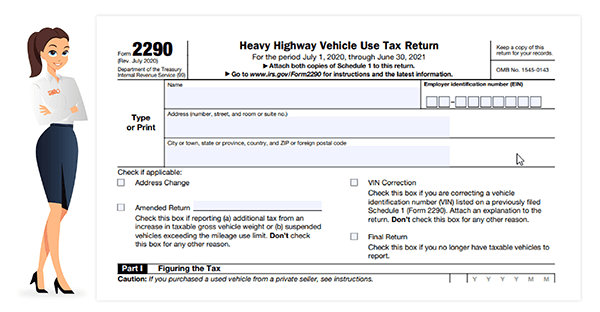

Save time with IRS-approved tools for fast and secure 2290 online filing

Save time with IRS-approved tools for fast and secure 2290 online filing

Blog Article

The IRS is always working to help improve the way taxes are filed and submitted. More and more people are choosing E-file to submit their taxes to the IRS. After an overwhelming response to E-filing in 2008 the IRS decided to improve this method of filing for 2010. Most of the accountant and CPA in New York and other cities have found it an easier way of filing taxes as it saves time.

For the illegal immigrants that are already here because we failed to enforce our own laws, we should provide immigration process offices across the country and give these people the opportunity to apply for American citizenship. The rules should include sufficient language skills, absolutely no criminal record, and proof that they can take care of themselves financially in every respect, or be sponsored by an American family or business. They should be required to pay 2290 tax form like everyone else and will receive the same protections and benefits that all American citizens receive. But nothing more. If these simple requirements are not met, they should be sent back to their homeland until they can meet them.

A major concern many people have is that they worry about their tax return disappearing Form 2290 online into the black hole of cyber-space never to been seen or heard from again until they receive a threatening letter from the IRS informing them that they have not filed a return. There is no need for fear, usually within 24 hours and almost never more then 48 hours the IRS sends a message to the transmitter (your accountant) either accepting the return or telling them that there are errors which must be corrected. In either case the process is transparent and foolproof ensuring that every return is accounted for.

If your dead set against building your site with a site builder and you want to try and tackle this thing by yourself I recommend Checking out 1&1 Web Hosting and HostGator when looking for the best web hosting IRS Form 2290 solution.

A major concern many people have is that they worry about their tax return disappearing into the black hole of cyber-space never to been seen or heard from again until they receive a threatening letter from the IRS heavy vehicle tax informing them that they have not filed a return. There is no need for fear, usually within 24 hours and almost never more then 48 hours the IRS sends a message to the transmitter (your accountant) either accepting the return or telling them that there are errors which must be corrected. In either case the process is transparent and foolproof ensuring that every return is accounted for.

You can request either type of transcript by mail or by phone. The phone number is 1-800-829-1040. If you wish to request a transcript by mail you'll need the IRS address that pertains to your specific area. If you need a photocopy of a previously processed tax return request Form 4506 which is a Request for Copy of Tax Form.

Of course to avoid having to go through all of this, please keep your income tax papers in a safe location where you're able to retrieve them when you need them.